Monday, September 28, 2009

Sunday, September 27, 2009

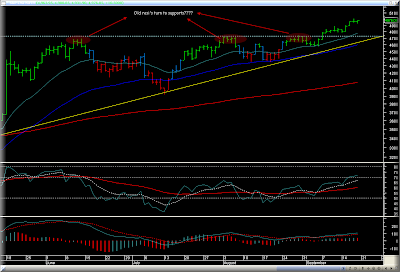

Shanghai Composite Views!!!

A look at the Shanghai Composite weekly chart below reveals that the price is nesting between the confluences of all the three moving averages on the weekly chart! The 20/50/200 are all between 2894 and 2720. I have also enlarged the last few weeks of the price action in candle stick form. Something strange here what looked like a morning start (see the firs three candles) is now morphing into an evening star (see last three candles). Na, not intending to confuse anyone here but only putting forth a point here; price is dynamic and so are patterns. Therefore it is always wise to wait for confirmation from the price action before getting all bullish or bearish about a pattern! A break and a close below the 200 MA (2700 approx), will straight lead to a testing the 2500 and trend line support below.

Ok letting some fantasies run wild here (anyways fantasies are meant to be wild!), the daily chart below shows price taking support at the 200 periods MA. Infact it’s just about managing to hang in there (last bar is an Inside Bar) and that to In the Down channel! A break from here can aggravate the fall to perhaps testing the channel support below. Whereas a rise from here and then overcoming the 3000/50 would put the inverse H&S shoulder into play (their you have it- A fantasy till proven true!) and also negate the falling channel.

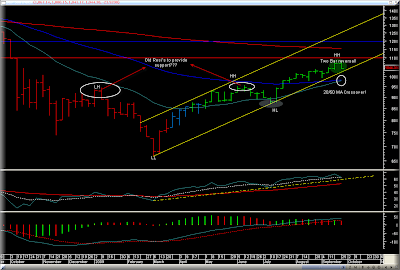

SnP 500 Views!!!

The weekly chart of SnP 500 below shows, a two bar reversal signifying a lil change in short term trend! But the bigger picture is still bullish! Well for starters we are still nicely advancing in a rising channel. We have a nice support happening at 980 odd levels where the 20 and the 50 periods MA are giving a crossover. More important is the level lat 935/50 which is likely to play a key role; Old Highs turn to Supports! And last but not the least we are yet to get the most important Dow Theory Signal; Failure to make a new high and then making a new lower low! Till these conditions hold we can safely assume the trend to be bullish on weekly chart. Period.

On the daily chart what now looks like a wedge is at important triple support zone;

- Pattern TL support

- Old Resistance (see ellipse) turn to support

- 20 periods Moving average!

Breaking and giving a close below these, means testing times for the 50 and the 200 periods MA’s below. By the way 200 MA on the daily is approximately at the same level where we have the 20/50 periods MA crossover happening on the weekly chart.

Bottom-line? Well 950/980 looks a good support for now and 1100/1150 a good resistance for the time being!

Saturday, September 26, 2009

Dollar Views!!!

Like commented last week the Dollar Index is at important support zone and any break down from here can lead to test the Lows and perhaps go on making new ones too! But we will get to that when we get there, as of now a quick glance at the weekly chart below tells us that USD Index needs to break out of this red band to breakout for a breather!

Even the daily chart with its Divergence is hinting at stretching out from here and test the 50 periods MA and the trend line resistance overhead.

Ok another angle I am putting forth is that while watching USD Index you might as well have an eye on the good old Japanese Yen! See the chart below which shows YEN vis a vis the USD. If the YEN breaks out of the Dec/Jan Highs (ellipses), that wouldn’t augur well for the dollar.

Illusion and Reality By Kabir Das!!!

Jo Dise So To Hai Nahin,

Hai So Kaha Na Jayee

Bin Dekhe Parteet Na Aave,

Kahe Na Koyee Patiyana

Samajh Hoye To Rabeen Cheenho,

Achraj Hoye Ayana Koi

![]()

Dhyave Nirakar Ko,

Koi Dhyave Aakaara

Ja Bidhi In Dono Te Nyara,

Jane Jananhara

Woh Raag To Likhia Na Jayee

Matra Lakhe Na Kana

Kahat Kabir So Padhe Na Parlay,

Surat Nirat Jin Jana

English Translation

What is seen is not the Truth

What is cannot be said

Trust comes not without seeing

Nor understanding without words

The wise comprehends with knowledge

To the ignorant it is but a wonder

Some worship the formless God

Some worship His various forms

In what way He is beyond these attributes

Only the Knower knows

That music cannot be written

How can then be the notes

Says Kabir, awareness alone will overcome illusion

Wednesday, September 23, 2009

Nifty At 5000.....Performance Pressure!!!

After a long long time Nifty gave a closing above 5000! The Bulls deserve all the accolades for this feat, infact Year 2009 should be a real satisfying year for the Bulls for what has been accomplished so far. But all this leads to something called REAL PERFORMANCE PRESSURE! See there are a lot of people both in retail and pros, who have missed this rally (none will admit it publicly)!

Infact the pressure is more on the professional side because these are the people who compete against each other therefore there performance is ranked not only vis a vis the Index but also vis a vis others. What I mean to say is that a whole lot of money managers and so called paid service guys will be under a lot of pressure to better the Index or at least better the nearest competitor. This where you need to be careful, if you missed the rally and holding cash you better be holding it tight. You wouldn’t like to get caught (getting in) NOW, coz like the picture above, when COCKS start to Lay EGGS (all sort of stocks start hitting circuits), you are better off on your own. Let the dust settle and slowly get into your choice of stocks on dips. Don’t rush in now and for heaven sake don’t berate yourself for missing out on this run up-for there be plenty of run ups still to come!

One of the most helpful things that anybody can learn is to give up trying to catch the last eighth - or the first. These are two most expensive eighths in the world... Larry Livingston

Monday, September 21, 2009

Nifty Views!!!

Below is the daily chart of Nifty, a slow and steady rise, betraying no signs of any sluggishness so far? A lot of positives already factored in and a whole lot of negatives already ignored! That’s what the markets are - Irrational! Correction though much anticipated can come any moment now, and on the other hand maybe we just go on making a cpl of more new highs. Speaking of corrections I would really sit up and take notice once we break the 4750/4700. As from the chart below you can see that is the triple tops (now resistances acting as supports funda) and the rising TL meet there!

The hourly chart below shows a small bull flag tryin2make yet another attempt at new highs! On the hourly chart Nifty has always been eagerly bought when it has retraced to the 20/50 periods MA’s! Good intraday support at 4930 odd levels, failing to hold on to these would result in a retest of 4880!

I would like to wrap up this post by quoting David Blair “In trading write your rules in INK and your opinions in Chalk!!!

Dollar Views!!!

A quick take on the USD index, below is the weekly chart ending with a Doji and that too right at important support turns resistance turn support zone (marked in blue band)? This is a good support for a breather and perhaps a lunge at the 20 periods MA. Anyway trading above 78 would be a sight for sore eyes of the Dollar bulls!

And the daily chart too shows some pause with positive divergence on the indicators. A Wolfe wave in the offing (shaded in green)??? Let’s see how this one pans out!

The Dick Davis Dividend- A Must Have Book In Your Library!!!

I haven’t been updating the blog this weekend as I was busy on catching up with some personal work and doing a bit of reading! I had the pleasure of re reading the book- The Dick Davis Dividend. Click on the image below to take you to Dick Davis site.

It’s a good book to have in your library. You see when someone with over 40 years of experience in the Wall Street writes something, it pays to listen. No this book aint about any get rich quick methods rather it’s about how to get rich slowly but surely! The book is full of hundreds of quotations by eminent personalities. These quotations in themselves are a delight to read! A no nonsense practical advisory is what you get when you buy this book. Will it make you rich? Not instantly but it will surely leave you a lot more wiser and that I presume is the first step to getting rich.

Here you can read Dick Davis’s interview with Charles Kirk!

Saturday, September 19, 2009

Thursday, September 17, 2009

A Nice Quote And An Intresting Read!

"October is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February." - Mark Twain

A.K. Prabhakar is one gentleman I respect a lot; today received the following message from him on my yahoo messenger, his observations;

“Sensex View:

• Sensex closes @ 16month high

• Sensex has doubled from March2009 low of 8047 in just 6month.

Sensex from low of 7697 on 27/Oct/2008 has made a 16month high of 16700 on 16/Sep/2009 which is more than double in 11months, time wise Sensex has taken 216trading days to reach here and 223 is an important Fibonacci number which comes next week around Derivative settlement.

Also from March lows it has completed 130 days where 134 is a Fibonacci number again. Derivative is heavily loaded with PCR=1.63 and Overall market Open interest Rs. 1,14,426 crs and with just 5trading days”

Continue reading his views at akprabhakar.blogspot.com !

Wednesday, September 16, 2009

Sunday, September 13, 2009

A Double Top Or A Double Bottom???

Wondering what type of a pattern is depicted in the picture below…A Double Bottom? Or a Double Top? Perhaps both!

Well this is the beauty of Technical Analysis; it shows each exactly the thing what one wants to see! And to think of it there is nothing wrong in it after all the pattern is in the eye of the beholder. Its often be repeated that Technical Analysis is not an exact science, rather it’s a game of probabilities and you would be better off if you treat Technical Analysis like that. It doesn’t matter whether you see the correct pattern or a setup, but what matters is that you follow it with good money management. Coz the crux is in the good money management…it’s this, what keeps you in the game even if you fail 6 times out of 10.

So to sum up one man’s Double Bottom can be another man’s Double Top and both can be right as long as they trade it with a plan and with STOPS! Stops let you decide what you want to relinquish and accept you were wrong in your analysis! Trading is not about being Right Always it’s about being on the Right Side and the Right Side is not about making profits it’s about protecting what you have…try and you will see profits trickling in!!!